current 40 year mortgage rates: key factors and comparisons

What affects today’s quotes

Current 40-year mortgages are less common than 30-year loans, and their rates often run slightly higher because of the longer payoff horizon and added risk. Quotes change daily and vary by lender, especially for non-QM or interest-only structures that many 40-year offerings use. Your personal profile still drives pricing.

- Credit score and DTI: Stronger files can trim rate or points.

- Points and buydowns: Paying upfront can reduce the note rate.

- ARM vs fixed: Hybrid ARMs may start lower but can adjust.

- Loan size and occupancy: Jumbo and investment properties price higher.

- Market forces: Inflation, Treasury yields, and Fed policy sway rate sheets.

How 40-year pricing compares

Relative to a 30-year, a 40-year quote typically carries a premium, reflecting longer duration and fewer secondary-market outlets. Lenders may offer wider spreads, tighter underwriting, and shorter rate-lock windows.

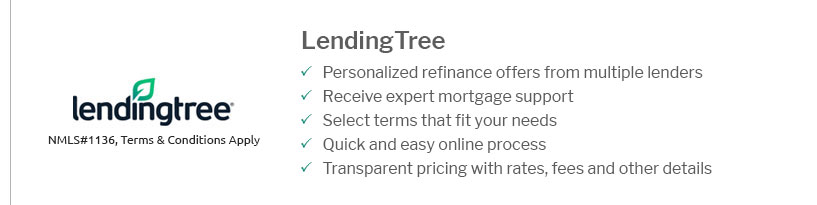

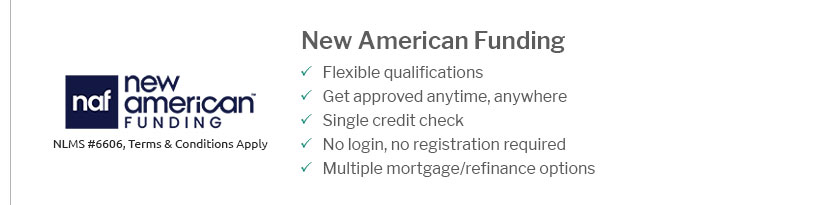

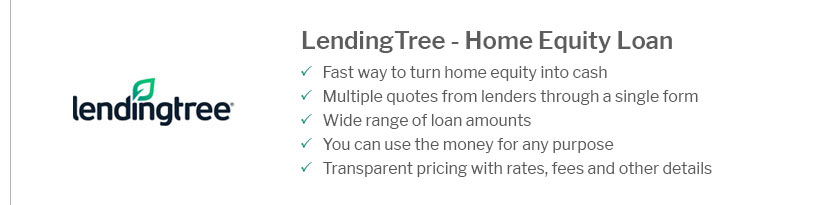

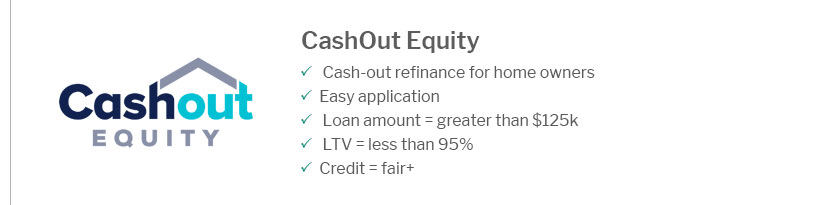

To evaluate offers, collect same-day quotes, compare APR, and model total interest paid and potential refinance scenarios. A 40-year can lower the monthly payment, but you may pay more interest over time. Review prepayment terms, recast options, and whether interest-only periods fit your plans before committing.